Wealth Watch Weekly E-Newsletter

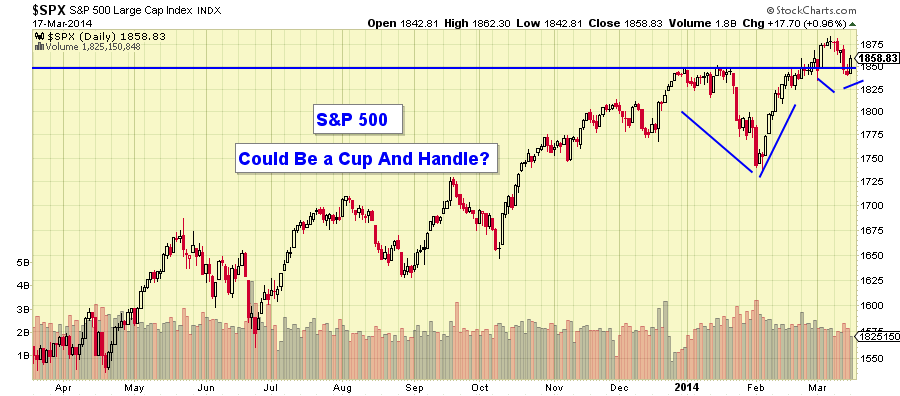

The markets could be setting up for a cup and handle pattern which is not a very common stock pattern. William O’Neal of Investor’s Business Daily has written about the cup and handle for decades now. Mr. O’Neal has preached about how powerful cup and handle patterns can be when they follow through. From my experience over the years, I could not agree more. It is a very strong break out pattern. But what Mr. O’Neal does not tell you is how hard they are to find and how seldom they form. This is one of the reasons why, when they do happen and follow through with a break out, they can be very explosive and profitable. The S&P, if it continues to base at this level, could be setting up nicely for the famous cup and handle pattern. We will be watching with much anticipation to see what the future will bring.

One thing that has always fascinated me is how so many people get so worked up by someone who says the sky is falling, if not today, then soon, so buy my newsletter. One letter, the Doom, Boom and Gloom report by Marc Faber, is one such letter. Just the title alone makes one want to jump out of a window. Negativity seems to really sell to a large number of people. Let me tell you one thing I do know. Marc Faber has no idea whether the markets will collapse, fall apart or even go up. No one can know that. It can’t be known, because it has not happened yet. No one can know the unknown future, but boy are there a lot of people out there who think someone has that kind of magic crystal ball. How would you like to have to spend a lot of time with someone who always thought in such a negative way? It would be so depressing. Have you ever noticed how the world’s second richest man, Warren Buffet, looks at the world? It is always with optimism and a positive outlook. Just watching him on CNBC makes you want to invest and go out and live a full life.

The market is in an uptrend. That we know and that is all we can know right now. Worrying about something bad that might, but probably never will, happen is a waste of time and a waste of a fun and enjoyable life. Turn off the negative media pundits. The way they make a living is by making you lose sleep at night.

The Optimized Trend Indicator (OTI) Stock of the Week is Ubiquiti Networks Inc (UBNT). The OTI called the start of an uptrend back around the first week of December 2012 when the stock price was in the 11.5-12 dollar range. Currently trading at around $55/share, it looks like the OTI has made another successful call on a stock trend.

|

Would you like advice on how to invest your company-sponsored retirement plan? Ask your advisor how the HCM 401(k) Optimizer® can help. This subscription service is now offered with a free basic subscription to LifeLock!

All programs offered by Howard CM are developed and run using Spartacus. It is a disciplined, systematic approach that removes guesswork from our trading. The power and strength of Spartacus are derived from three major components: the process is mechanical, non-emotional, and repeatable.

Howard Capital Management’s investment strategies are designed to protect capital in market downturns and to outperform the major indexes during market upswings. To help accomplish this goal, we developed the HCM-BuyLine®, a proprietary indicator used to identify the trend of the market. The HCM-BuyLine® signals when and how much to invest in equities. Although its design is technical, its interpretation is straightforward. It produces a measurement of the number of buyers and sellers, and gives us a non-emotional indicator of the intermediate-term trend of the market

|

This newsletter is a publication of Howard Capital Management, Inc. It should not be regarded as a complete analysis of the subjects discussed nor should the newsletter be construed as personalized investment advice. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. It should not be viewed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

Disclaimer. This communication is issued by Howard Capital Management, Inc. It is for informational purposes and is not an official confirmation of terms. It is not guaranteed as to accuracy, nor is it a complete statement of the financial products or markets referred to. Opinions expressed are subject to change without notice. Howard Capital Management, Inc. may maintain long or short positions in the financial instruments referred to and may transact in them as principal or agent. Unless stated specifically otherwise, this is not a recommendation, offer or solicitation to buy or sell and any prices or quotations contained herein are indicative only. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment or investment strategy will be equal to past performance level or that it will match or outperform any particular benchmark. To the extent permitted by law, Howard Capital Management, Inc. does not accept any liability arising from the use of this communication.

Past performance is no guarantee of future returns.

IMPORTANT DISCLOSURE INFORMATION

LIMITATIONS OF HCM OPTIMIZED TREND INDICATOR (OTI)

Please Note: The HCM Optimized Trend Indicator (“OTI”) is a tool developed by Howard Capital Management, Inc. (“Howard”) to help assist a subscriber to determine what portion, if any, of the subscriber’s company stock should be bought, sold or held in the subscriber’s retirement portfolio as of a particular date. Subscriber maintains absolute discretion as to whether or not to follow the OTI. It remains the subscriber’s exclusive responsibility to review and evaluate the OTI and his/her company stock and to determine whether to accept or reject any recommendation and to correspondingly determine whether any OTI recommendation is appropriate for his/her financial situation, or investment objective (for which Howard has and expresses no knowledge or opinion).

Howard does not offer or provide investment implementation services, nor does it offer or provide initial or ongoing individual personalized OTI advice (neither in person nor via the Internet) to Optimizer subscribers.. Howard will not have and will not accept any trading authority for the subscriber’s retirement account. Thus, it shall always remain the subscriber’s exclusive responsibility to review and evaluate the OTI and to determine whether to accept or reject any OTI recommendation, and if accepted, to then subsequently implement such recommendation on his/her own without assistance from Howard.

The subscriber acknowledges and understands that the OTI is an opinion only, based upon Howard’s judgment as of a particular date. The OTI opinion could be wrong. No current or prospective subscriber should assume that investment in, or purchase and sale of, his/her company stock based upon the OTI will be profitable for his/her retirement portfolio. Unlike the mutual funds that are available for investment in the subscriber’s retirement portfolio, individual equities such as the subscriber’s company stock are not diversified positions, and may be subject to greater volatility and principal risk. Subscribers should be guided accordingly.

Subscribers do not receive investment supervisory or investment management services from Howard. The OTI is not tailored to any particular subscriber’s individual’s risk parameters, financial situation, or investment objective(s). It is the subscriber’s exclusive responsibility to determine what portion of company stock, if any, is suitable for his/her financial situation and/or investment objectives, both initially and on an ongoing basis. No subscriber should assume that his/her subscription serves as a substitute for individual personalized investment supervisory and/or management services from an investment professional of the subscriber’s choosing regarding the ownership of the subscriber’s company stock in the subscriber’s retirement portfolio.

Please Remember: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a subscriber or prospective subscriber’s investment portfolio. Therefore, no current or prospective subscriber should assume that investment in his company stock is appropriate for his/her financial situation or investment objective, or that the future performance of his/her company stock will be profitable or equal any specific performance level(s).

RELEASE: Each subscriber or prospective subscriber acknowledges and accepts the limitations of the OTI and agrees, as a condition precedent to his/her access to the OTI, to release and hold harmless Howard, its members, officers, directors, owners, employees, affiliates, and agents from any and all adverse consequences resulting from his/her/its use of OTI, including, but not limited to, investment losses resulting from the subscriber’s implementation of any of OTI recommendations.

© 2013 Howard Capital Management, Inc. All rights reserved. Intended for receipt only and not for further distribution without the consent of Howard Capital Management, Inc.

555 Sun Valley Drive, Suite B4 Roswell, Georgia 30076 United States

|

|